Paris Aligned Asset Owners is an outcome of the Paris Aligned Investment Initiative (PAII), which was established in May 2019 as a collaborative investor-led forum (coordinated by AIGCC, Ceres, IGCC and IIGCC) to support investors to align their portfolios and investment activities to the goals of the Paris Agreement.

The PAII’s core publication is the Net Zero Investment Framework. As per Point 2 of the PAAO commitment statement, signatories are expected to draw on the Net Zero Investment Framework.

For more information on Governance, please click here.

The Net Zero Investment Framework

The Net Zero Investment Framework 1.0 defines methodologies and approaches for investors to align portfolios to the goals of the Paris Agreement and maximise the contribution they can make to achieving global net zero global emissions by 2050.

118 investors representing $34 trillion in assets engaged in the development of the Net Zero Investment Framework 2019-2021.

The Net Zero Investment Framework is the most implemented net zero methodology for investors and across all financial institutions within the Glasgow Financial Alliance for Net Zero (GFANZ).

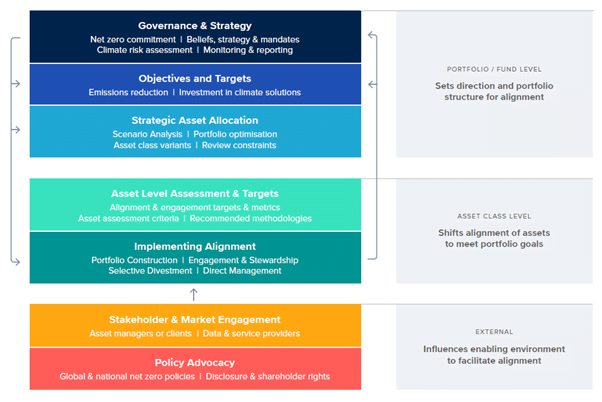

The primary objective of the Framework is to enable investors to decarbonise investment portfolios and increase investment in climate solutions, in a way that is consistent with achieving global net zero emissions by 2050 or sooner, and maximises decarbonisation of the real economy. The Framework provides investors with robust guidance in relation to governance, targets, strategic asset allocation, market engagement and policy advocacy.

There are several key outputs that support Paris Aligned Asset Owners in implementing the Net Zero Investment Framework:

- The Framework currently provides guidance on listed equity, corporate fixed income, real estate and sovereign bonds.

- A Net Zero Investment Framework component for infrastructure was published in March 2023.

- A Net Zero Investment Framework component for private equity was published in May 2023.

- Additional asset classes, derivatives and hedge funds are due to be integrated into the Framework in 2024.

IIGCC Resources:

- The Supplementary Target Setting Guidance provides step-by-step guidance for investors implementing the recommendations of the Net Zero Investment Framework. The guidance supports asset owners utilising the Framework to establish their targets in line with the Paris Aligned Asset Owner commitment, covering asset and portfolio level target setting, case studies and downloadable worked examples.

- A portfolio testing report, setting out the results of an exercise to test the application of the Framework on five investor portfolios. This showed that investors can align portfolios in line with the recommendations of the Framework, and this is a no-regrets choice with scope for significant benefit over business-as-usual, with respect to managing climate-related risks.